45 coupon interest rate definition

Coupon Rate: Definition, Formula & Calculation - Video ... The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the... Is coupon rate the same as interest rate? - AskingLot.com Definition of 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also.Coupon rate is not the same as the rate of interest.

Coupon definition — AccountingTools Coupon definition December 27, 2021 / Steven Bragg. Related Courses. Revenue Management. ... A coupon is also the annual interest rate paid on a bond, stated as a percentage of the face value of the bond. It may also be referred to as the coupon rate. December 27, 2021 / Steven Bragg /

Coupon interest rate definition

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate , which refers to the bond's yield at the date of issuance. Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

Coupon interest rate definition. Bond Yield: Definition & Calculation with Interest Rates ... Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually Difference Between Coupon Rate and Interest Rate | Compare ... Coupon Rate is the yield that is being paid off for a fixed income security like bonds. This rate usually represents as an annual payment paid by the issuing party considering the face value or principal of the security. Issuer is the one who decides this rate. What Is a Coupon Rate? And How Does It Affects the Price ... Such amount of interest is called coupon rate of interest. The coupon rate is fixed over time. For example, a bond with a face value of $1,000 and a 5% coupon rate pays $50 to the bondholder until its maturity. It does not matter if the bond price rises or falls in value over the period. The amount of coupon interest that is $ 50 needs to be ... Coupon Rate vs Interest Rate | Top 8 Best Differences ... a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Coupon Interest Rate: What is Coupon Interest Rate? Fixed ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... Coupon interest rate financial definition of coupon ... coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence? Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What Is the Coupon Rate of a Bond? A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. Difference Between Coupon Rate and Interest Rate (With ... The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond. Coupon rate financial definition of Coupon rate Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Practice problems - Consider a bond paying a coupon rate of 10 per year semiannually when the ...

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds.

Difference Between Coupon Rate and Interest Rate | Compare the Difference Between Similar Terms

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

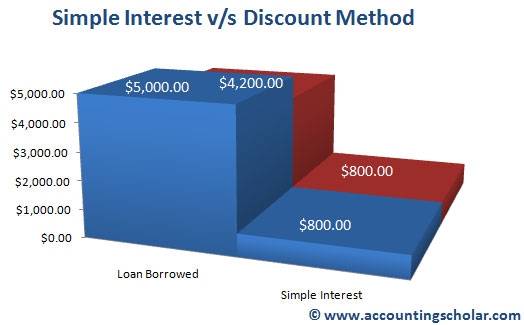

Difference Between Coupon Rate and Required Return (With ... Coupon Rate: Required Return: Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100

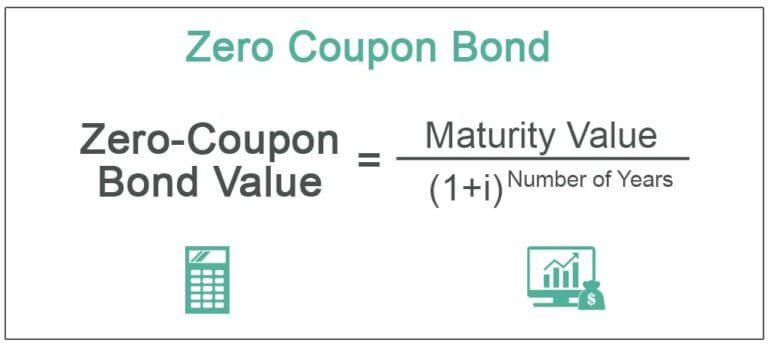

Coupon Interest | Insurance Glossary Definition | IRMI.com Coupon Interest — the rate of interest paid to the holders of a bond. This rate can be either a floating variable or fixed rate. Often, zero coupon bonds are issued that pay no interest until the bond is redeemed to guarantee repayment of the principal of the bond or specific tranche.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer

Learn About Coupon Interest Rates | Chegg.com The coupon interest rate indicates the annual interest rate paid by the issuer of the bond, taking into consideration its face value. The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer.

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate , which refers to the bond's yield at the date of issuance.

Post a Comment for "45 coupon interest rate definition"