45 yield to maturity of a zero coupon bond

Chapter 6 | Corporate Finance - Uni Regensburg Identify the cash flows for both coupon bonds and zero- coupon bonds, and calculate the value for each type of bond. • Calculate the yield to maturity for ...119 pages Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

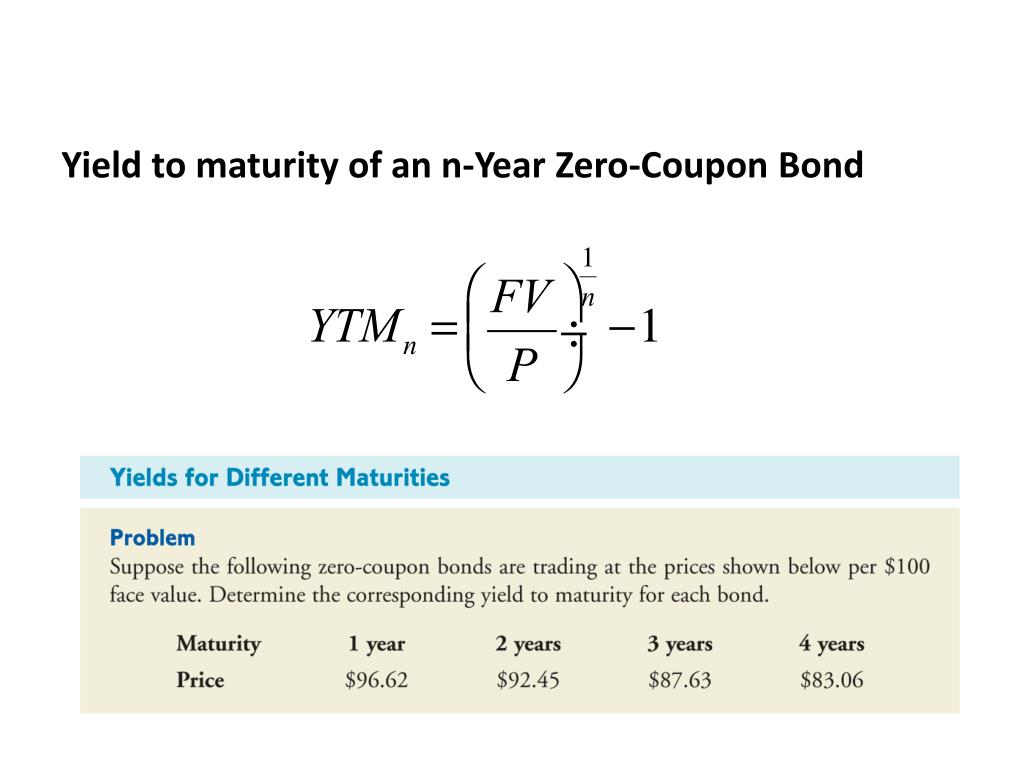

Yield to maturity of a zero coupon bond

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. › terms › yYield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Realized Compound Yield versus Yield to Maturity - Rate Return With a reinvestment rate equal to the 10% yield to maturity, the realized compound yield equals yield to maturity. But what if the reinvestment rate is not 10%? If the coupon can be invested at more than 10%, funds will grow to more than $1,210, and the realized compound return will exceed 10%. If the reinvestment rate is less than 10%, so will ...

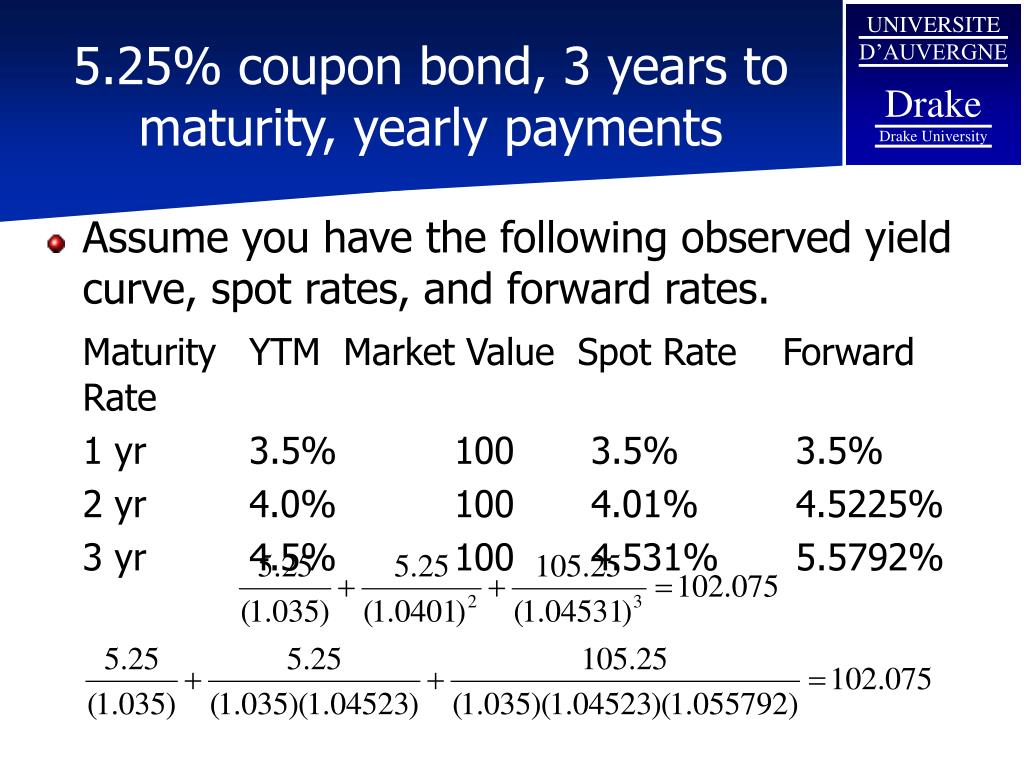

Yield to maturity of a zero coupon bond. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income Calculate Formula Excel Bond To How Price Formula & Example The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816 The bond provides …. In Excel 2007 onwards, you can also use the table formulas to extract data from a table In ... › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

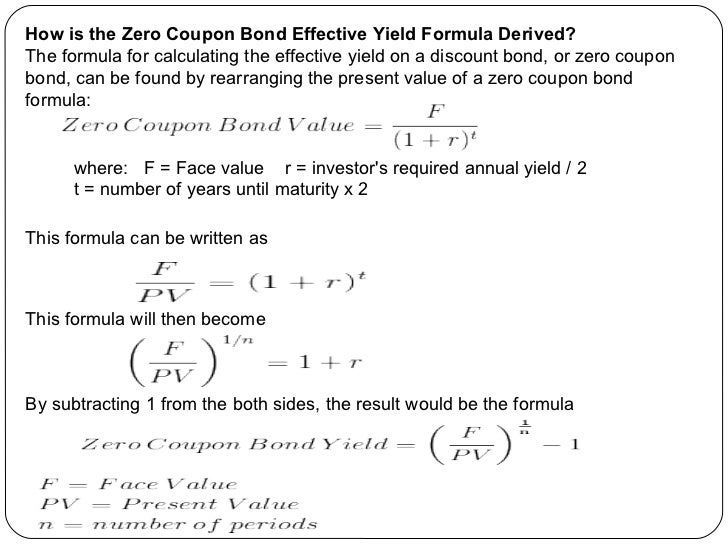

Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20 ... Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). PDF Zero Coupon Yield Curves Technical Documentation Bis Zero Coupon Yield Curve - The Thai Bond Market Association (1 months ago) above the zero-coupon curve for bonds with maturity less than 5 years,while the current yield curve becomes lower than the zero-coupon curve for bonds with maturity more than 5 years.There does exist a relationship between the two yield curves.In practice,bonds are usually

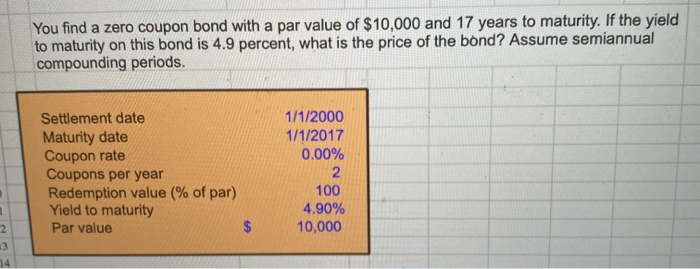

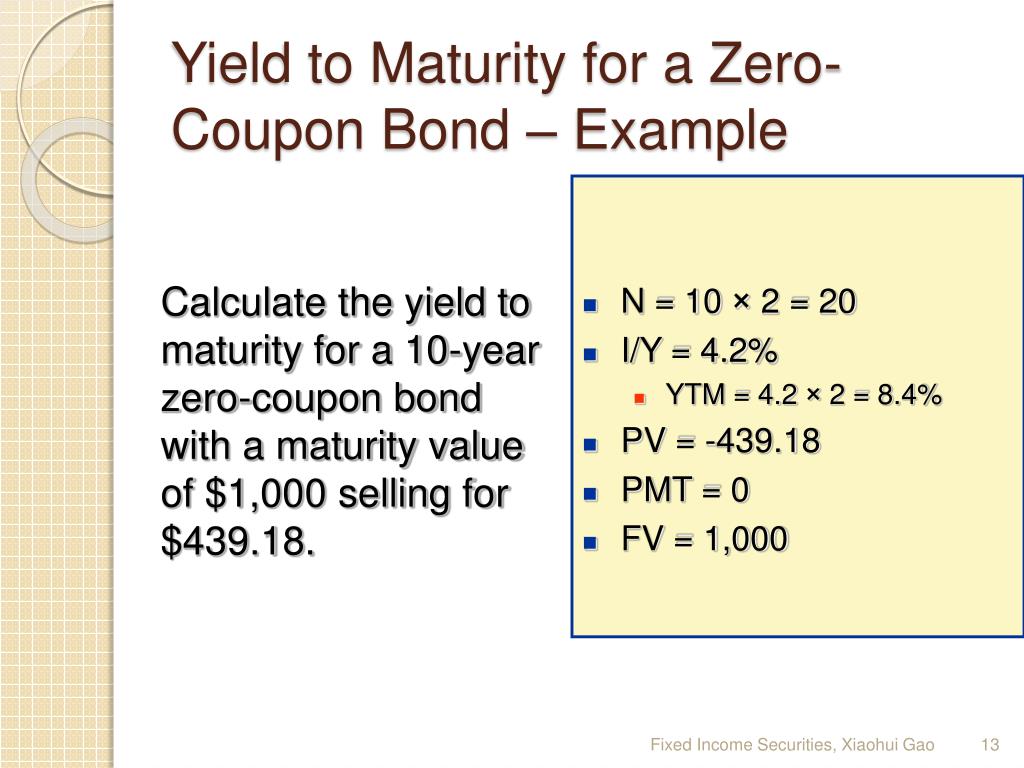

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math - Ebrary However, there is no inherent reason why the annual yield on a zero-coupon bond cannot be calculated for quarterly, monthly, daily, or even hourly compounding. Those yields turn out to be 5.141%, 5.119%, 5.109%, and 5.108% using PER = 4,12, 365, and 365 * 24, respectively. Alternatively, you could convert from any one periodicity to any other ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Calculate Yield To Maturity Of A Zero Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53.

Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Zero-Coupon Bond - Definition, How It Works, Formula | Wall Street Oasis A 25% return over 5 years is equivalent to 4.56% compounded returns over the five-year holding period of the bond. Calculating the price of zero coupon bond: The yield to maturity formula can be used to calculate the present value of the bond. By rearranging the above formula, the present value of the bond can be calculated as. where,

bloomberg bond yield calculator - kikuyajp.com Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate … 1. This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. UK 10 Year Yield.

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Example 2 compute the price of a zero coupon bond NOMINAL YIELD • Nominal yield, is the stated interest rate of the bond. • This yield percentage is the percentage of par value • E.g. RM5,000 for Yankee bonds, and RM1,000 for most other bonds — that is usually paid semiannually. • Thus, a bond with a RM1,000 par value that pays 5% interest pays RM50 dollars per year in 2 semi-annual payments of RM25. ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Solutions to Problem Set 2 - Wharton Finance (a) The annual return in this case equals the yield to maturity. ... maturity, the yield to maturity for a zero coupon bond is given by: YTM = (F.5 pages

Yield to Maturity - NYU Stern The higher the coupon, the closer the bond's yield is to the annuity rate. The lower the coupon, the closer the bond's yield is to the zero rate.14 pages

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://d2vlcm61l7u1fs.cloudfront.net/media/a6d/a6d9a045-4c4d-413c-a5a5-6b37b2d46e5a/phpSMkGD9.png)

Post a Comment for "45 yield to maturity of a zero coupon bond"