39 how does zero coupon bond work

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Zero Coupon Muni Bonds - What You Need to Know - MunicipalBonds.com The largest benefit of zero coupon muni bonds is the low minimum investment since the securities are sold at a discount to face value. For example, a bond with a face value of $10,000 that matures in 20 years with a 5.5% coupon may be purchased for less than $5,000. This means that investors can purchase more face value at a lower upfront ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

How does zero coupon bond work

Zero-Coupon Bonds : r/Superstonk - reddit How do they work? Zero-Coupon bonds pay no interest but trade at a deep discount and pay a profit when the bond matures. The difference between the purchase price and the value of the bond is the investor's return. For example, if a zero-interest bond has a face value of 1000 in 5 years, they may sell for 800 right now. Coupon Bond - Guide, Examples, How Coupon Bonds Work How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. What Is a Zero-Coupon Bond? Definition, Advantages, Risks 28 Jul 2022 — A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity.

How does zero coupon bond work. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Zero Coupon Bonds assures a fixed maturity amount after a certain period. Therefore, the investors who have want to get a fixed return in future with less market risk should go for these bonds. Even if you are an aggressive investor and always hunting for good stocks, you may still invest in these bonds to balance your portfolio.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero-Coupon Bonds - Accounting Hub The formula to calculate the market value of the zero-coupon bond is: Price = M / (1+r) n Where M = face value or maturity value of the bond R = required rate of interest N = number of years Suppose a bond issuer needs to issue a zero-coupon bond with a face value of $10,000 with 10 years of maturity. The investors' expected rate of return is 5%. Zero Coupon Bonds Explained (With Examples) - Fervent The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1... Zero Coupon Bond Funds: What Are They? - thebalancemoney.com A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds. Note

How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid...

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face...

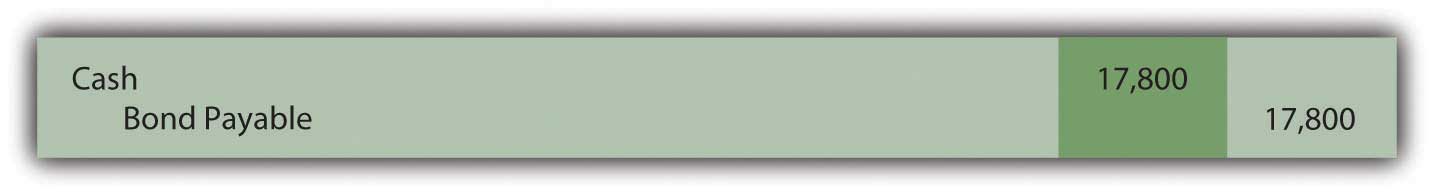

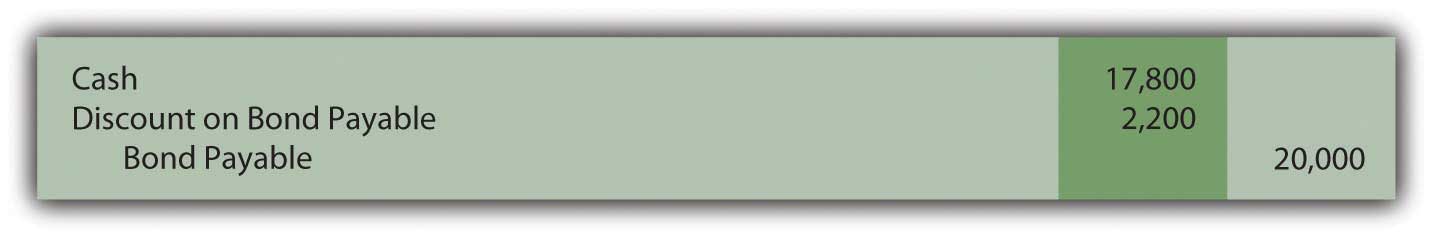

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... A zero-coupon bond is a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep How Do Zero Coupon Bonds Work? Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par)

Zero Coupon Bond - Explained - The Business Professor, LLC How Does a Zero-Coupon Bond Work? Bonds are methods for companies to raise capital. Bond purchasers are lenders to the company. The company is the debtor. Most bonds pay interest (a coupon) annually or semi-annually throughout the duration of the bond.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Banks and brokerage firms can also create zero-coupon bonds. These entities take a regular bond and remove the coupon to create a pair of new securities. This process is often referred to...

Tax Considerations for Zero Coupon Bonds - Financial Web Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement. It can, of course, be difficult for some ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero-Coupon CDs: What They Are And How They Work | Bankrate How zero-coupon CDs work. You pay a discounted price for a zero-coupon CD in exchange for not being paid interest throughout the term. You receive the full face value of the CD once it matures ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks 28 Jul 2022 — A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity.

Coupon Bond - Guide, Examples, How Coupon Bonds Work How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity.

Zero-Coupon Bonds : r/Superstonk - reddit How do they work? Zero-Coupon bonds pay no interest but trade at a deep discount and pay a profit when the bond matures. The difference between the purchase price and the value of the bond is the investor's return. For example, if a zero-interest bond has a face value of 1000 in 5 years, they may sell for 800 right now.

Post a Comment for "39 how does zero coupon bond work"