38 coupon rate and ytm

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Difference between Coupon Rate And Yield To Maturity - Angel One Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...

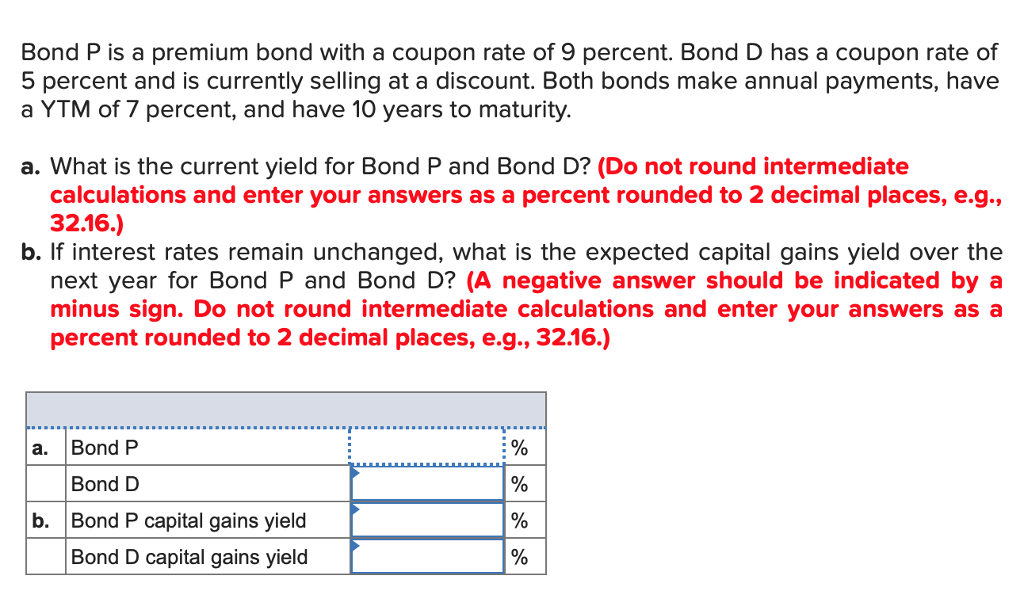

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield ...

Coupon rate and ytm

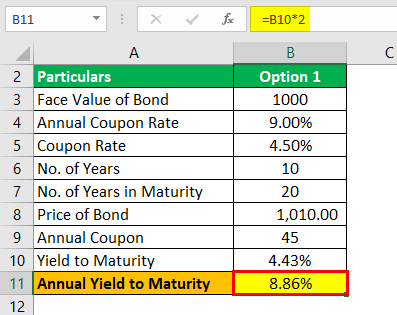

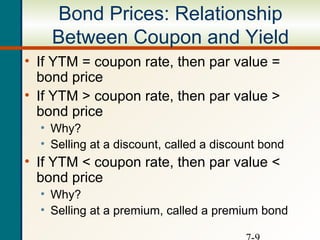

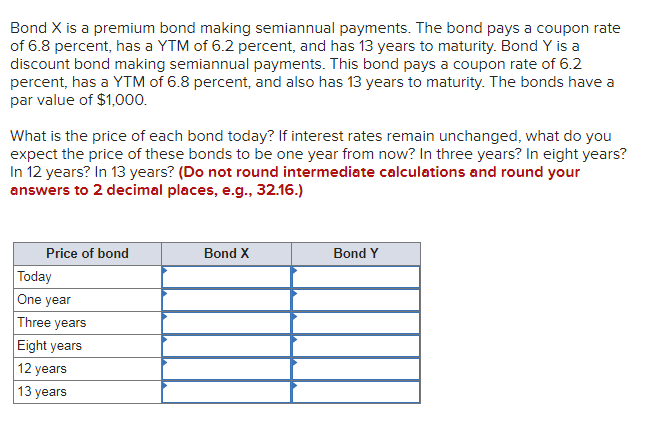

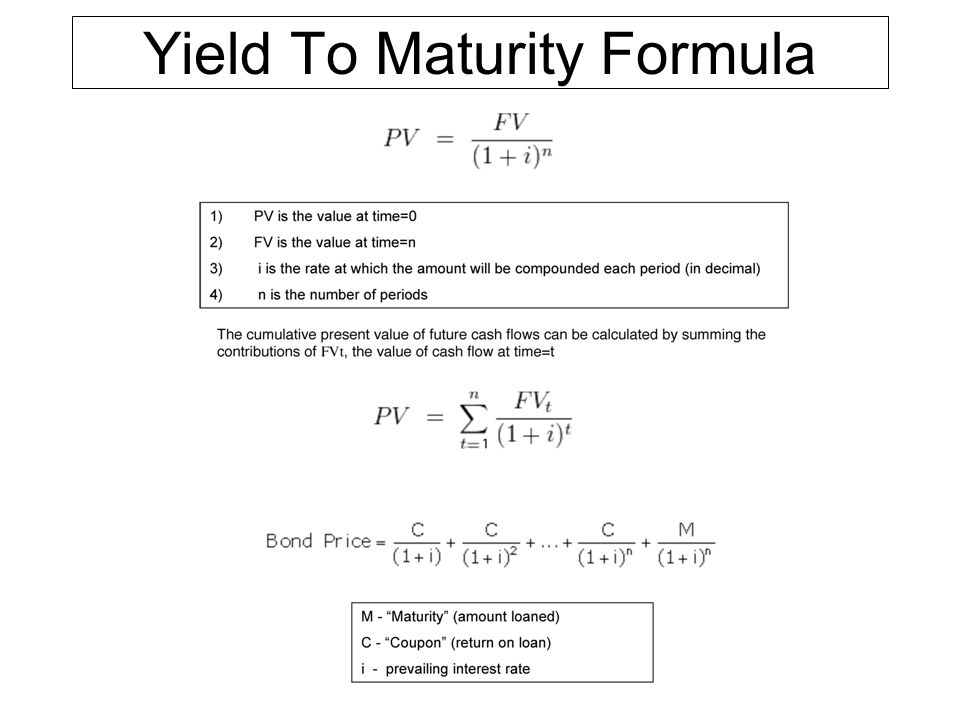

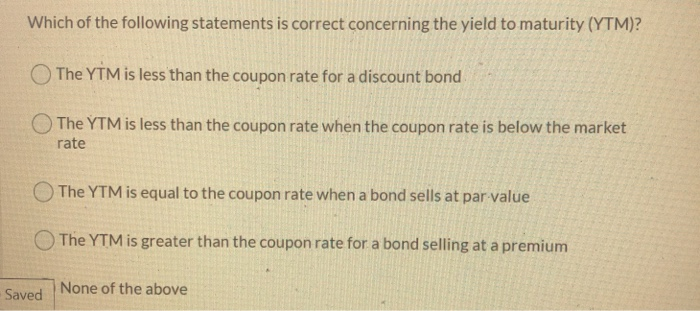

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... Yield to maturity - Fixed income - Robeco The YTM can be used to evaluate the current valuation of a bond by comparing it with its coupon rate, where the latter is a simpler calculation of the ... Concept 82: Relationships among a Bond's Price, Coupon Rate ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ...

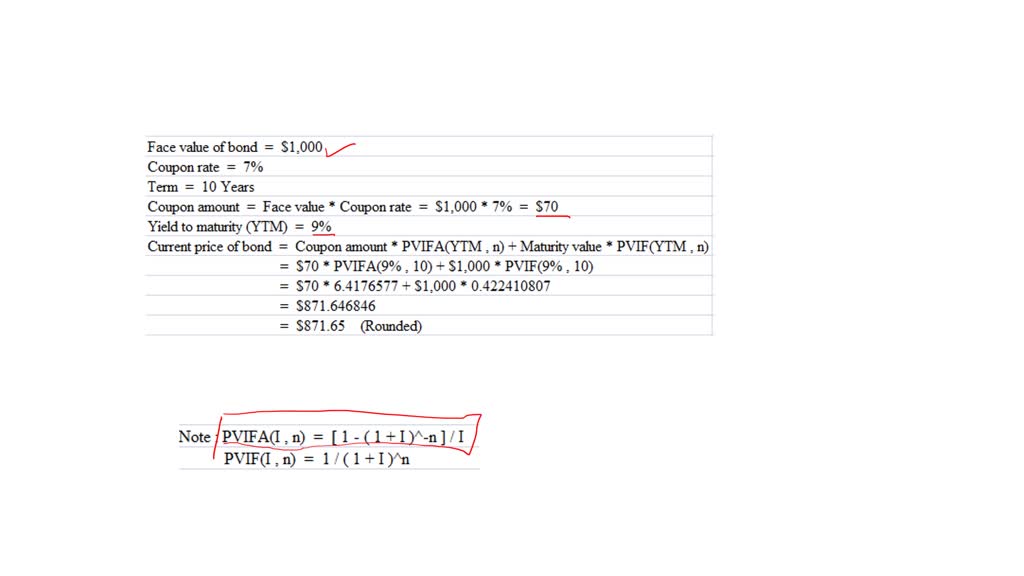

Coupon rate and ytm. Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total ... Yield to Maturity (YTM) - Wall Street Prep An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the ... Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ... The Difference Between Coupon and Yield to Maturity - The Balance Mar 4, 2021 ... To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount ...

Concept 82: Relationships among a Bond's Price, Coupon Rate ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ... Yield to maturity - Fixed income - Robeco The YTM can be used to evaluate the current valuation of a bond by comparing it with its coupon rate, where the latter is a simpler calculation of the ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ...

Post a Comment for "38 coupon rate and ytm"