40 duration of a coupon bond

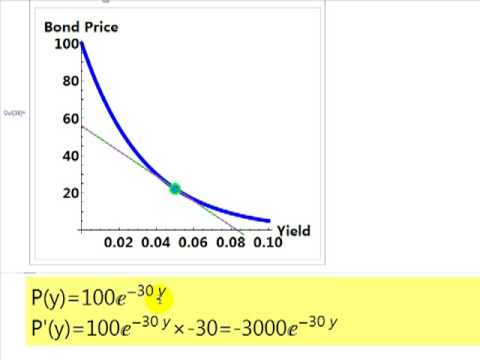

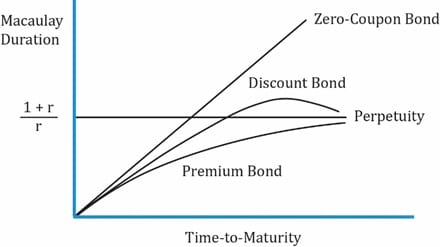

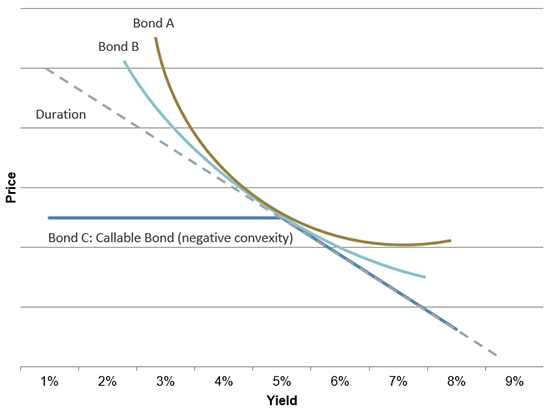

The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

Duration of a coupon bond

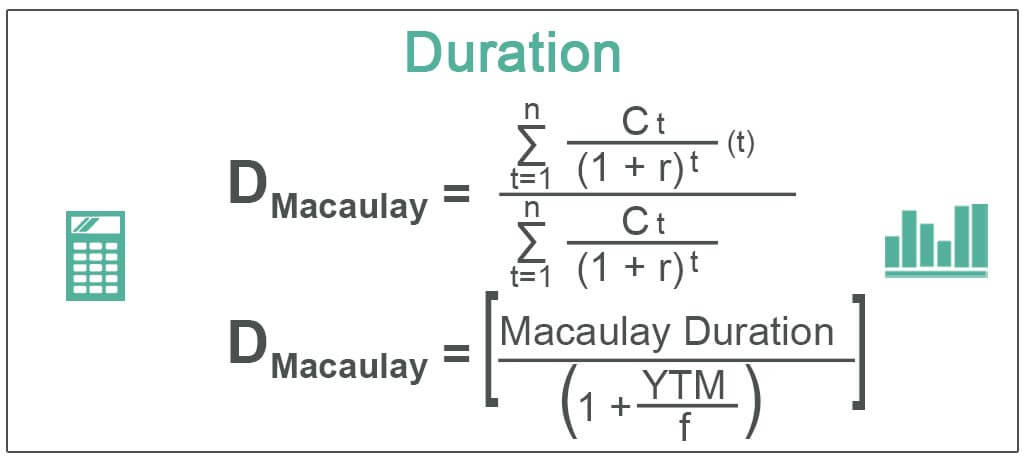

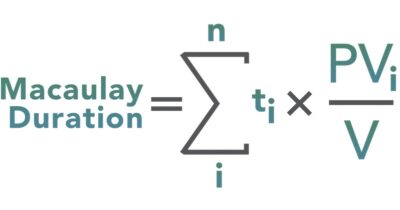

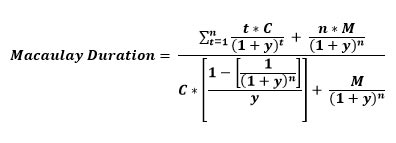

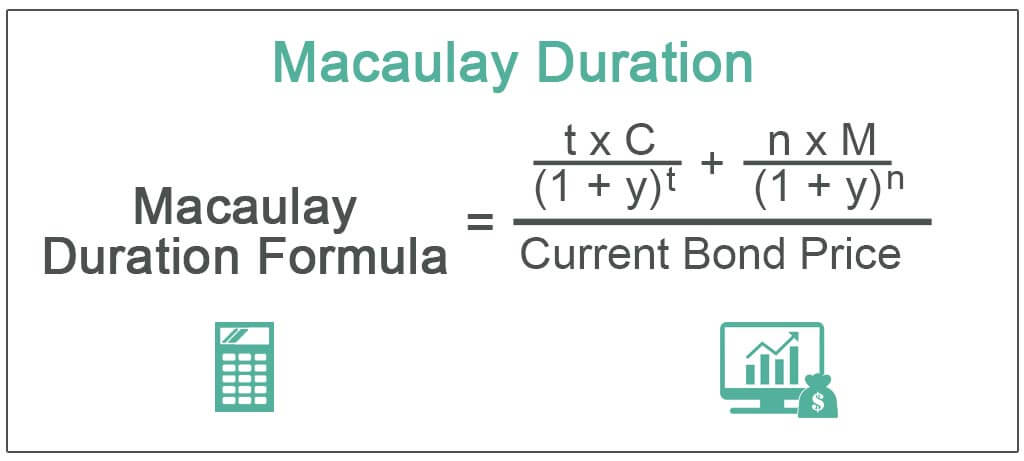

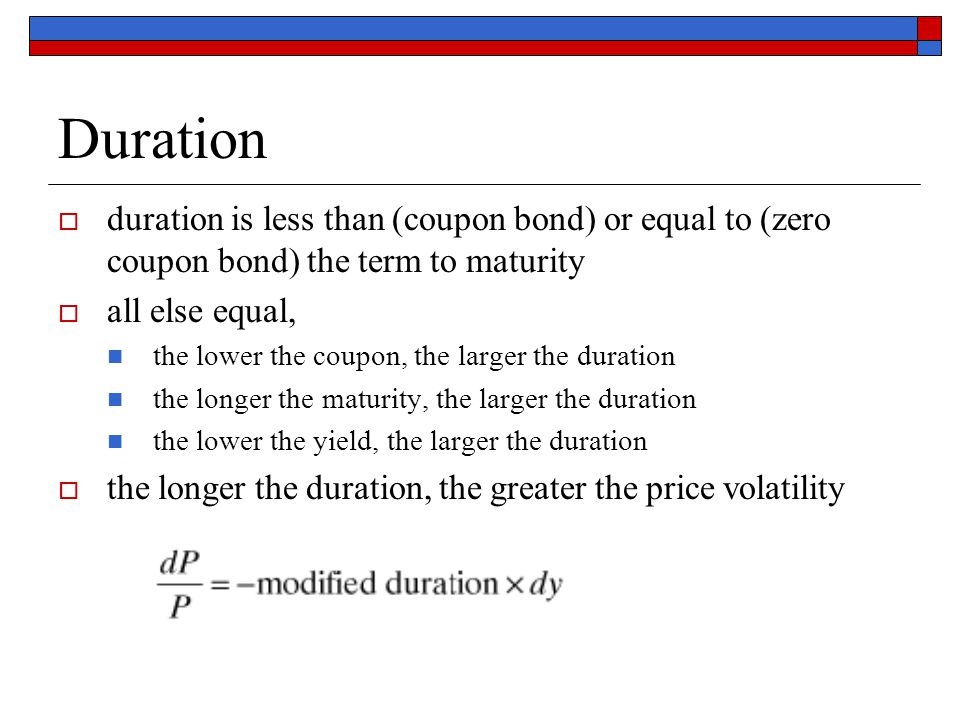

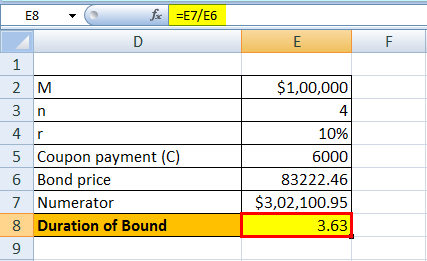

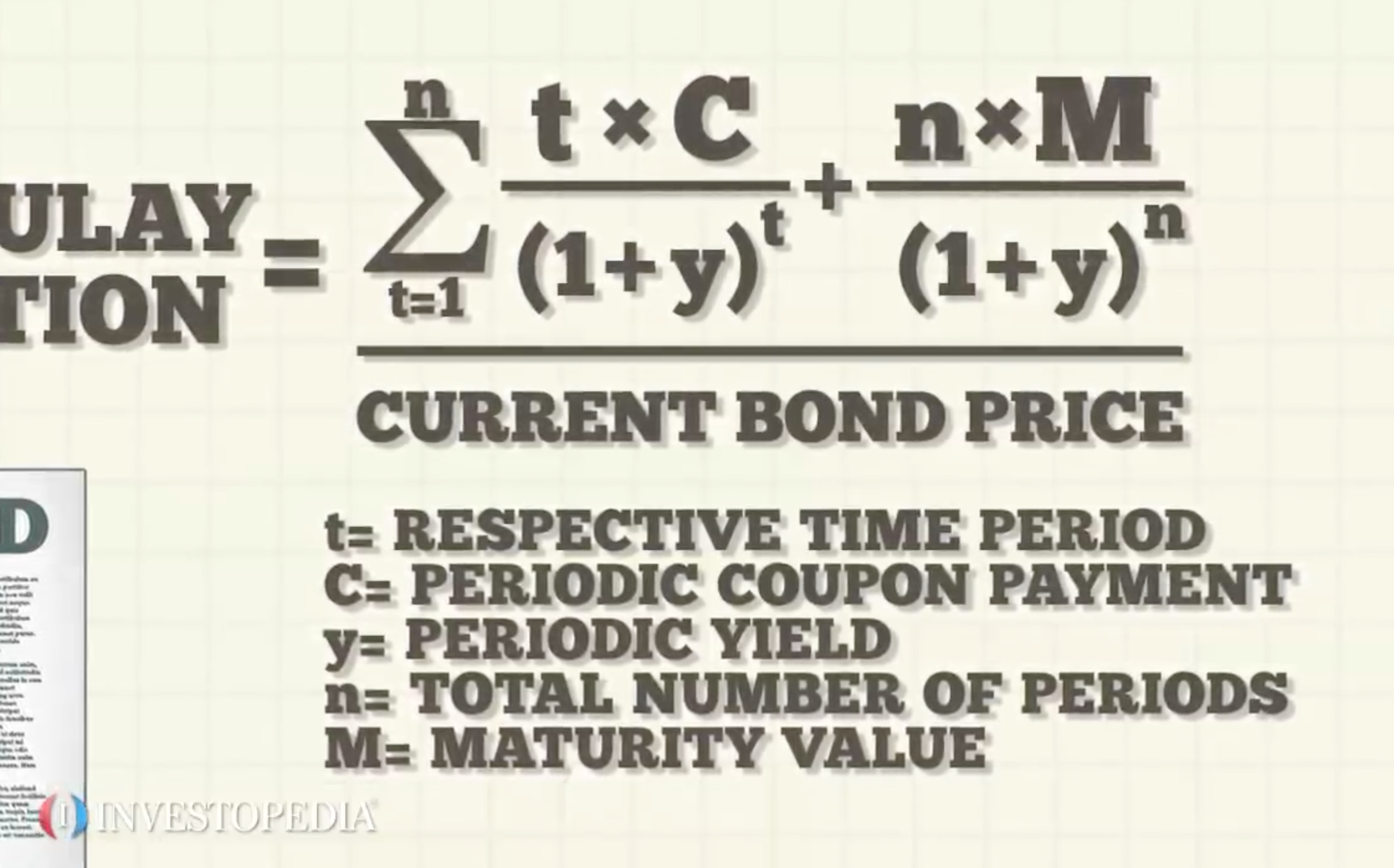

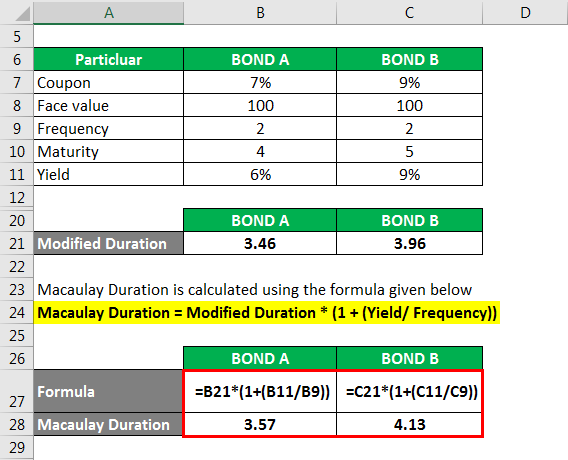

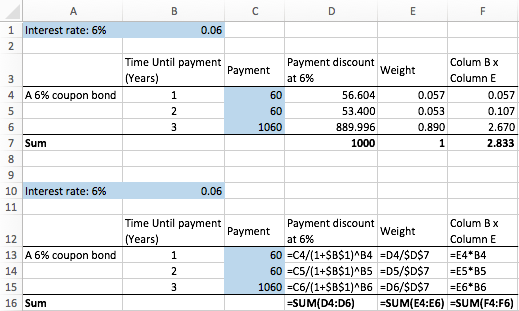

What Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ... How to Calculate Macaulay Duration in Excel - Investopedia Aug 20, 2022 · For instance, say you want to calculate the modified Macaulay duration of a 10-year bond with a settlement date on Jan. 1, 2020, a maturity date on Jan. 1, 2030, an annual coupon rate of 5%, and ... Bond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB.

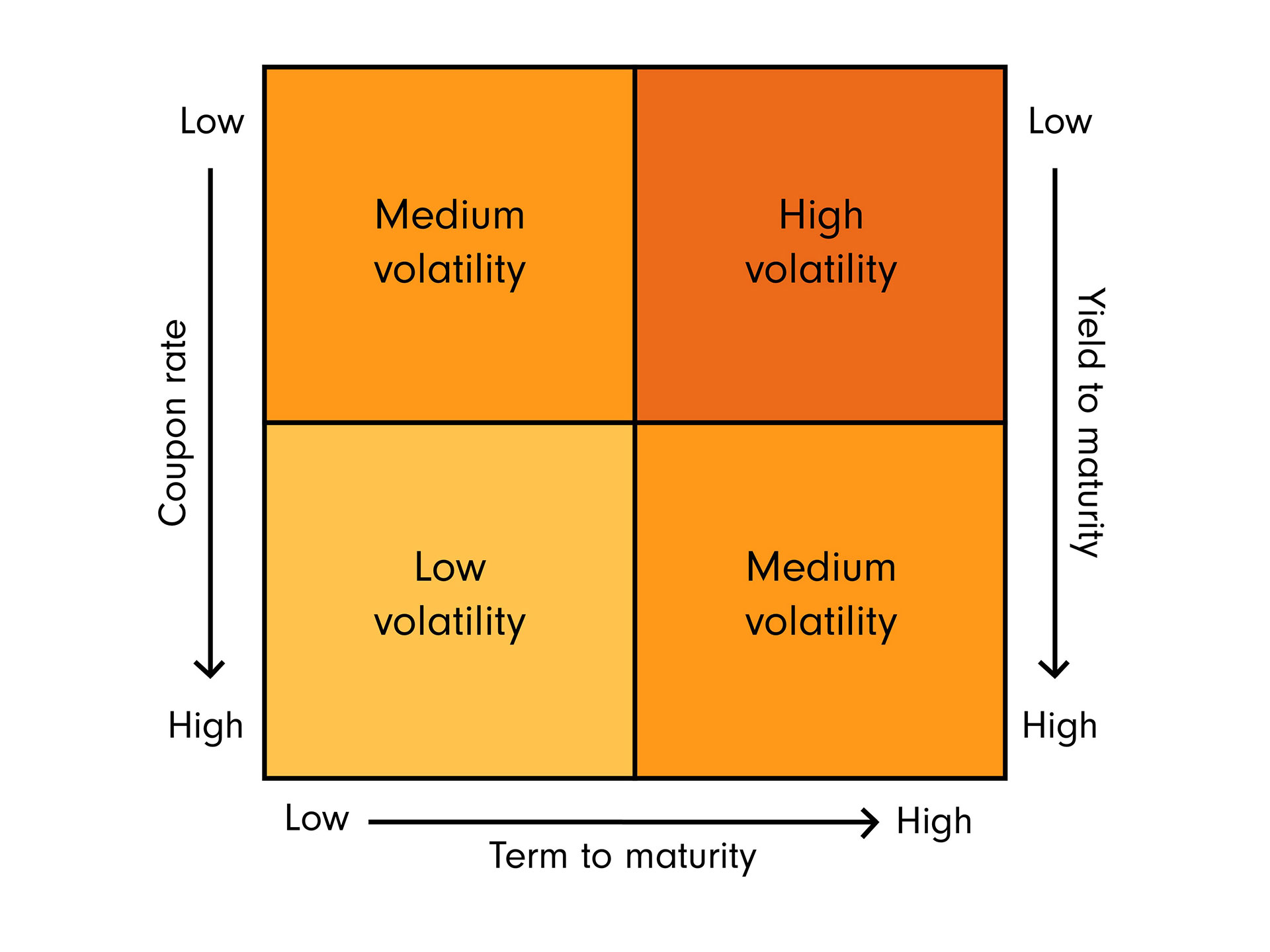

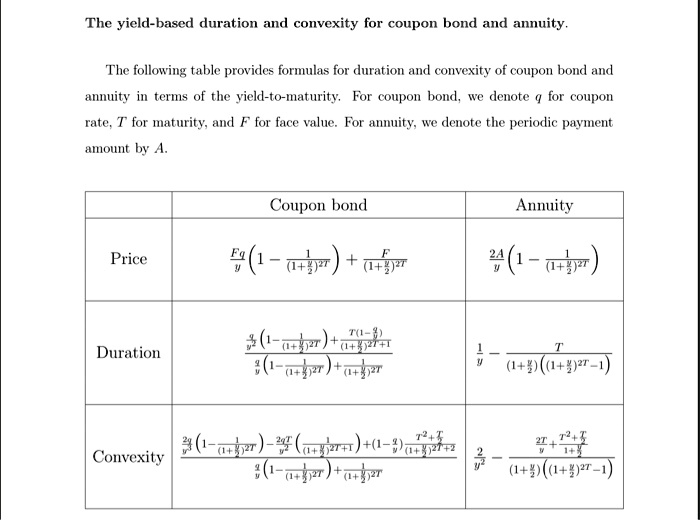

Duration of a coupon bond. Convexity of a Bond | Formula | Duration | Calculation For a Bond of Face Value USD1,000 with a semi-annual coupon of 8.0% and a yield of 10% and 6 years to maturity and a present price of 911.37, the duration is 4.82 years, the modified duration is 4.59, and the calculation for Convexity would be: Bond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB. How to Calculate Macaulay Duration in Excel - Investopedia Aug 20, 2022 · For instance, say you want to calculate the modified Macaulay duration of a 10-year bond with a settlement date on Jan. 1, 2020, a maturity date on Jan. 1, 2030, an annual coupon rate of 5%, and ... What Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ...

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

![Duration and Convexity [Concepts Series] | by Byrne Hobart ...](https://miro.medium.com/max/934/1*sId1I-O1GXScie24NpUXyQ.png)

Post a Comment for "40 duration of a coupon bond"