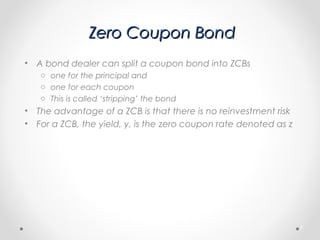

42 advantage of zero coupon bond

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. What are Zero Coupon Bonds? | Features, Advantages, Disadvatages Advantages of Zero Coupon Bonds Long-Term in Nature Conservation of Cash No Reinvestment Risk Disadvantages of Zero Coupon Bonds Taxability Loss of Interest Highly Fluctuation Market Prices High Repayment Risk Return of Investors

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Since the Interest accrued is discounted from the Par value of such Bonds at purchase, which effectively enables Investors of Zero Coupon Bonds to buy a greater number of such bonds compared to any other Coupon Bearing Bond. Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula:

Advantage of zero coupon bond

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

Advantage of zero coupon bond. Zero-Coupon Bond - an overview | ScienceDirect Topics Moorad Choudhry, in The Bond & Money Markets, 2001. 14.5.2 Bond interest payment. Corporate bonds pay a fixed or floating-rate coupon. Floating-rate bonds were reviewed in Chapter 5. Zero-coupon bonds are also popular in the corporate market, indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually issued by the borrower, rather than ... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Long-time horizon: The long time horizon of the Zero Coupon bond is a significant advantage for long-term investors. A fixed amount can be availed via a long-term investment without worrying about any market turmoil. Disadvantages of Zero-Coupon Bonds

Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations. What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. What is the disadvantage of issue zero coupon bond? - Quora What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond?

› Immortal-Life-Henrietta-Lacks › dpAmazon.com. Spend less. Smile more. Amazon.com. Spend less. Smile more. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ... Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "42 advantage of zero coupon bond"