41 duration for zero coupon bond

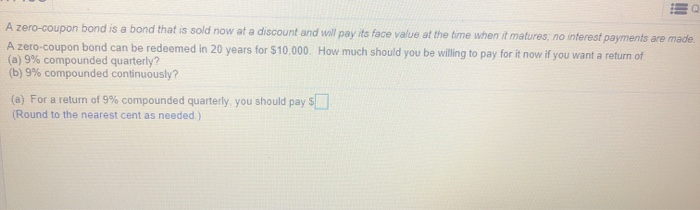

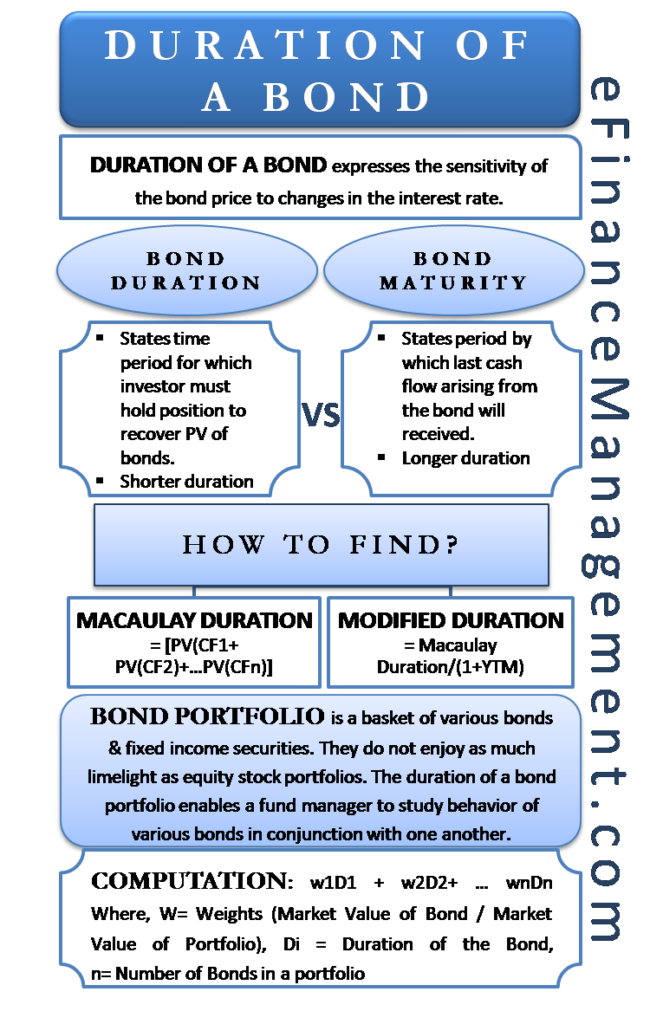

Macaulay's Duration | Formula | Example - XPLAIND.com Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Annual coupon is $50 (i.e. 5% of the $1,000) and the maturity value is $1,000. Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE.

Zero-coupon bond - Bogleheads For instance, a 30-year bond with a 5% coupon has a duration of just over 15 years; by contrast, a 30-year zero has a duration of 30 years. Therefore, in a deflationary crisis where long-term Treasuries are expected to do well, zero-coupon Treasuries (STRIPS) will be the best performers. ... Zero-coupon bonds, when combined with the call option ...

Duration for zero coupon bond

4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ...7 pages Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... investinganswers.com › dictionary › dDuration | Definition & Examples | InvestingAnswers Jan 10, 2021 · The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds – which have only one cash flow – have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. 3 ...

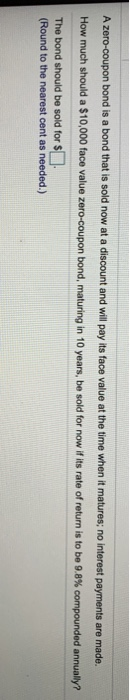

Duration for zero coupon bond. The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates.

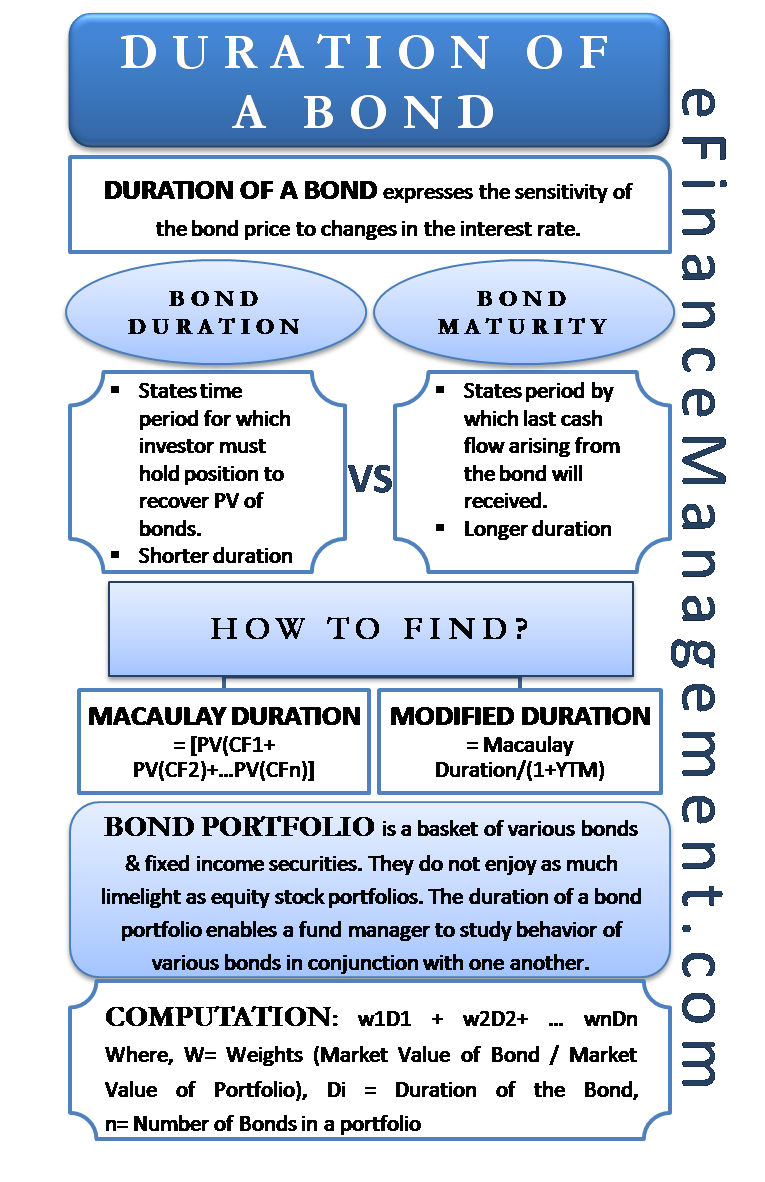

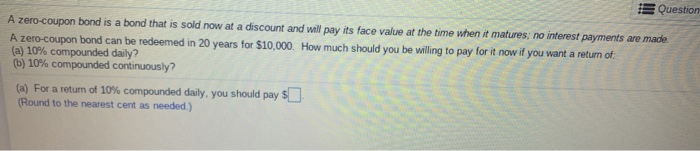

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Macaulay Duration - Overview, How To Calculate, Factors A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. Macaulay duration also demonstrates an inverse relationship with yield to maturity. Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

fixed income - Duration of callable zero coupon bond - Quantitative ... What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal to its maturity. But I am not getting convinced with my answer because of the callable feature in the question. dqydj.com › bond-duration-calculatorBond Duration Calculator – Macaulay and Modified ... - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ... › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Solved What will be the duration of a zero coupon bond - Chegg Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. 100% (1 rating) ANSWER - Duration of Zero coupon bond (ZCB) is the maturity time of the bond is 5 years. Basically duration of the bond is the time at which the payments received …. View the full answer.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount ...12 answers · 16 votes: The duration of a zero coupon bond is the number of years to maturity

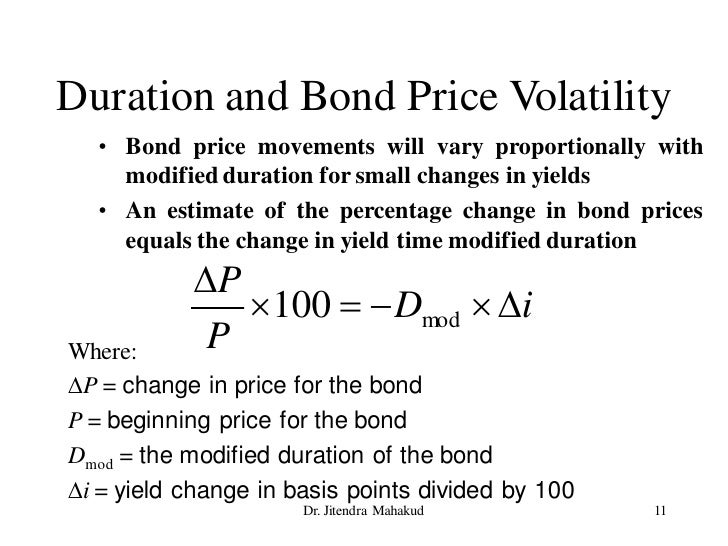

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Zero-Coupon Bond: Formula and Excel Calculator Generally, zero-coupon bonds have maturities of around 10+ years, which is why a substantial portion of the investor base has longer-term expected holding periods.

What is the difference between a zero-coupon bond and a regular bond? Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion....

risk management - Calculate duration of zero coupon bond - Quantitative ... Calculate duration of zero coupon bond. Ask Question Asked 2 years, 5 months ago. Modified 2 years ago. Viewed 150 times ... Let Pz (t, T ) be the price of a zero coupon bond at time t with maturity T and continuously compounded interest rate r. Duration = $-\frac{1}{P} \frac{d P}{d r}$

What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Buying Treasury zeros has become much more straightforward with ETFs. The Vanguard Extended Duration Treasury ETF ... If a zero-coupon bond is purchased for $1,000 and given away as a gift, the ...

thismatter.com › money › bondsDuration and Convexity, with Illustrations and Formulas Therefore, Frederick Macaulay reasoned that a better measure of interest rate risk is to consider a coupon bond as a series of zero-coupon bonds, where each payment is a zero-coupon bond weighted by the present value of the payment divided by the bond price. Hence, duration is the effective maturity of a bond, which is why it is measured in ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

› convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield.

Post a Comment for "41 duration for zero coupon bond"