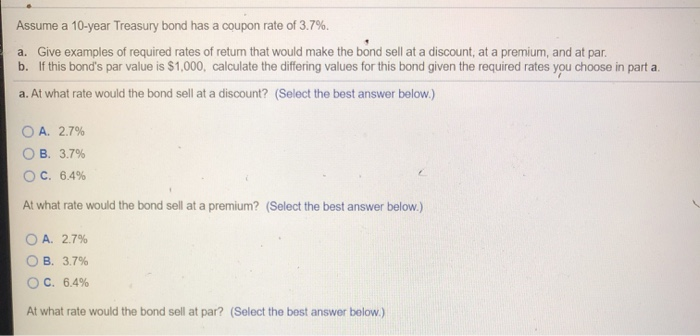

38 coupon rate 10 year treasury

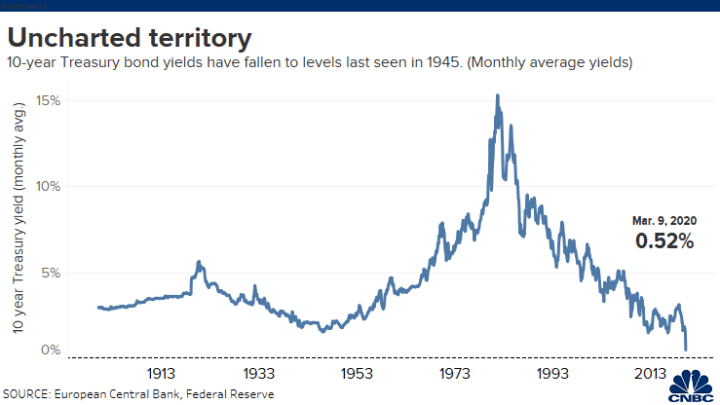

10-Year High Quality Market (HQM) Corporate Bond Spot Rate Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Sep 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA. TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview 7.10.2022 · Aggressive rally in U.S. government debt sends Treasury yields down by 10 to 15 basis points each, led by drop in 3-year rate; 10-year dips below 2.75% May. 24, 2022 at 10:09 a.m. ET by Vivien Lou ...

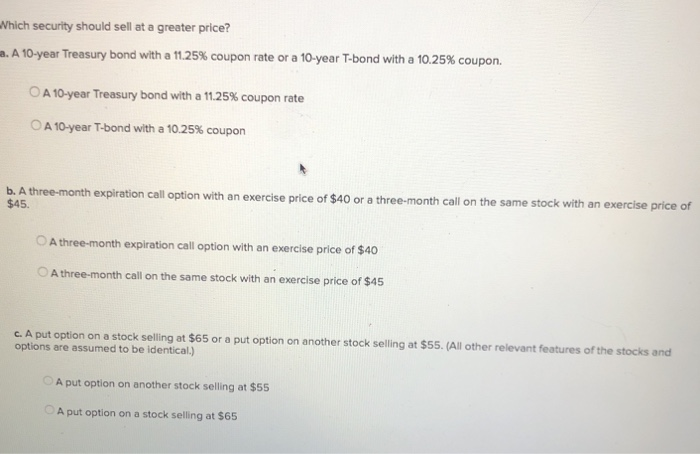

How Is the Interest Rate on a Treasury Bond Determined? 29.8.2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Coupon rate 10 year treasury

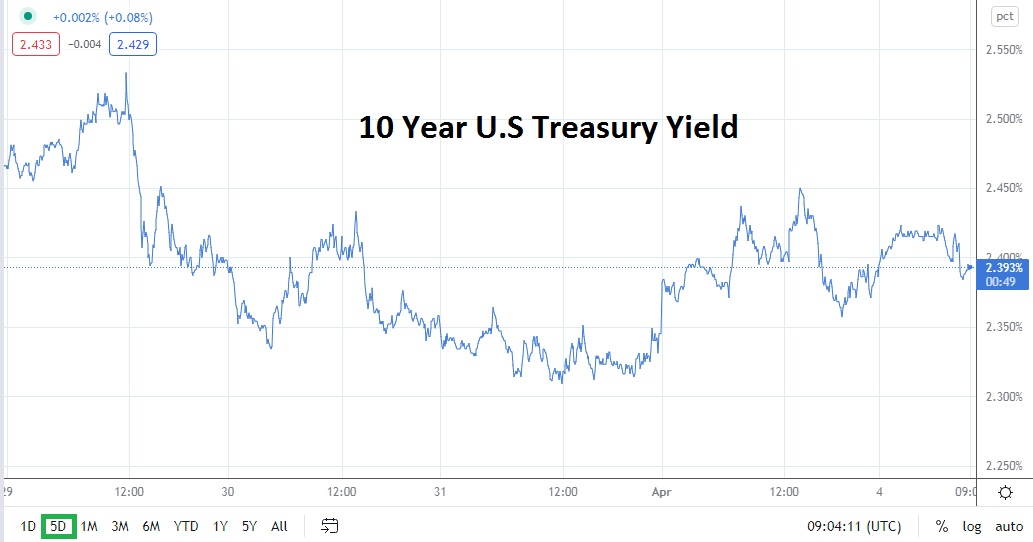

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; 10-Year Treasury Note and How It Works - The Balance 24.3.2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ... TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch 7.10.2022 · TMUBMUSD01Y | A complete U.S. 1 Year Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

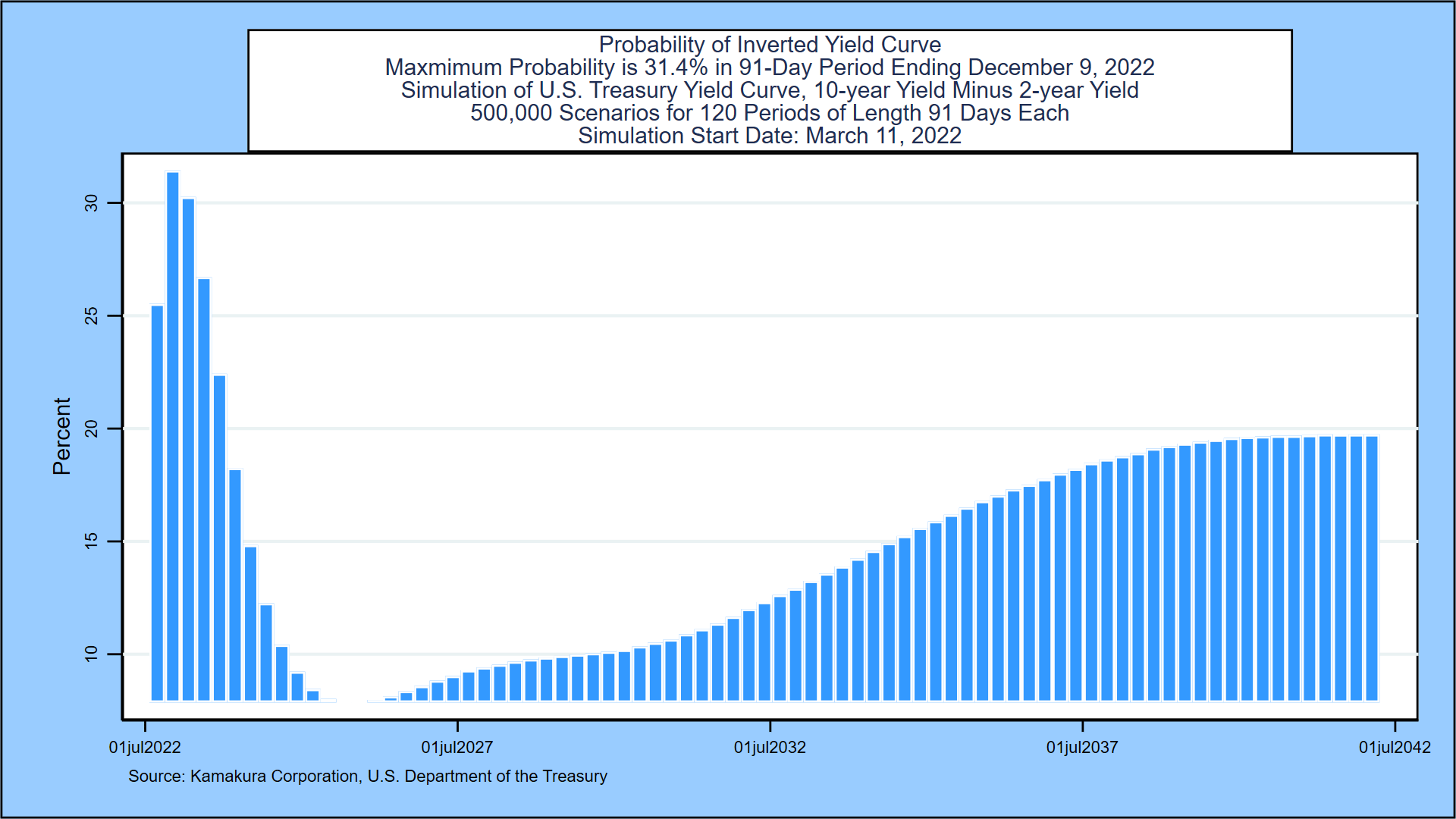

Coupon rate 10 year treasury. Micro 10-Year Yield Quotes - CME Group 10.10.2022 · Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. United States Rates & Bonds - Bloomberg Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 3.25: 3.32% +32 ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 3.05: ... Muni Bonds 10 Year Yield . 3.17% +1 +43 ... United States 10-Year Bond Yield - Investing.com India United States 10-Year Bond Yield Overview The U.S. 10-Year Bond is a debt obligation note by The United States Treasury, that has the eventual maturity of 10 years. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity, and should be monitored closely as an indicator of the government debt situation.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch 7.10.2022 · TMUBMUSD01Y | A complete U.S. 1 Year Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates. 10-Year Treasury Note and How It Works - The Balance 24.3.2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ... Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "38 coupon rate 10 year treasury"