42 yield to maturity for zero coupon bond

Interest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, … Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield curve - Wikipedia The team extended the maturity of European yield curves up to 50 years (for the lira, French franc, Deutsche mark, Danish krone and many other currencies including the ecu). This innovation was a major contribution towards the issuance of long dated zero-coupon bonds and the creation of long dated mortgages.

Yield to maturity for zero coupon bond

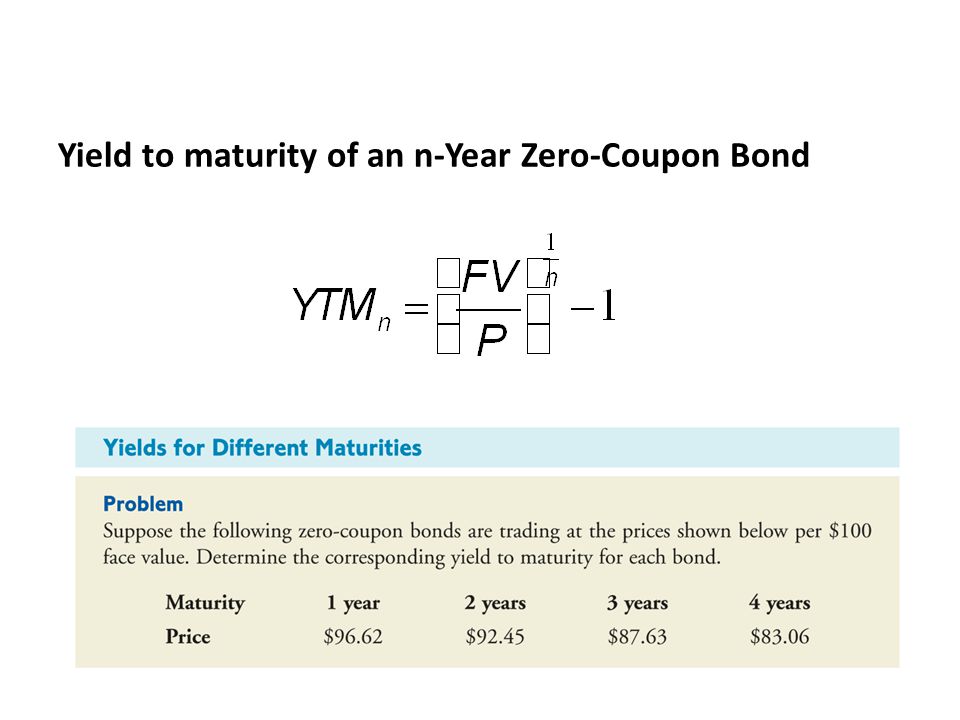

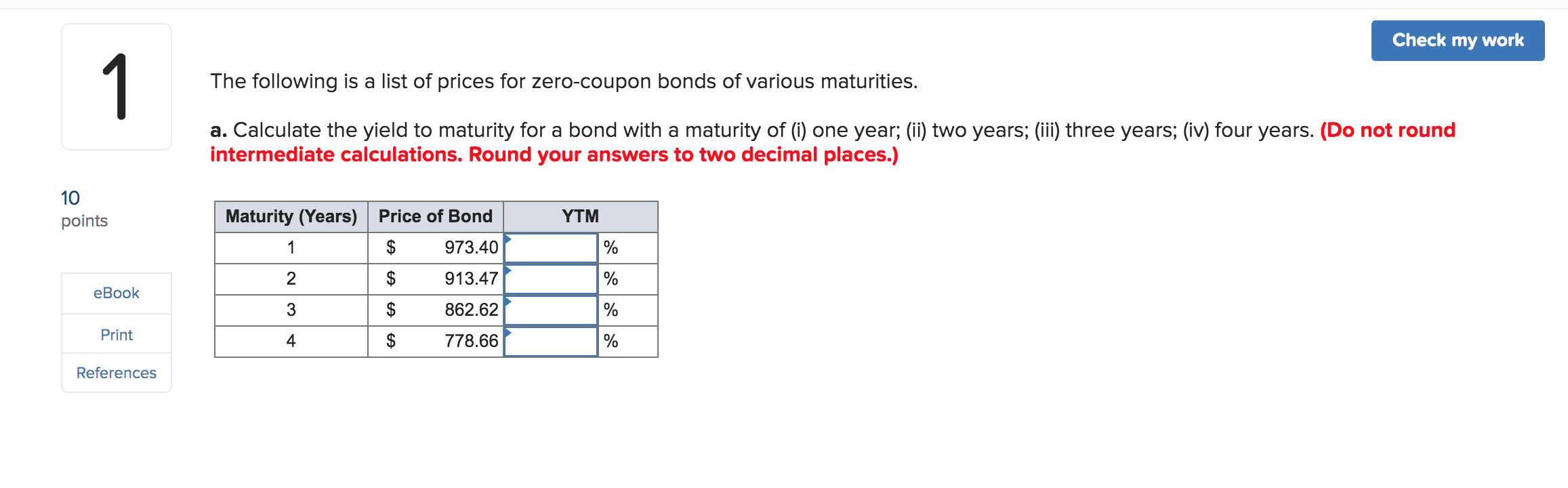

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1 Zero-Coupon Bond YTM Example Consider a $1,000...

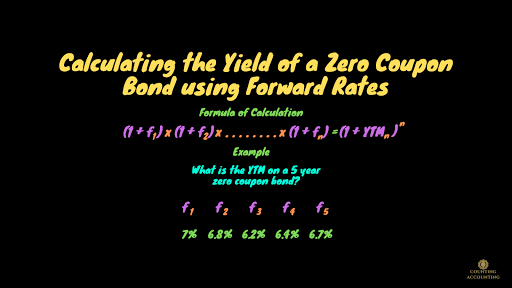

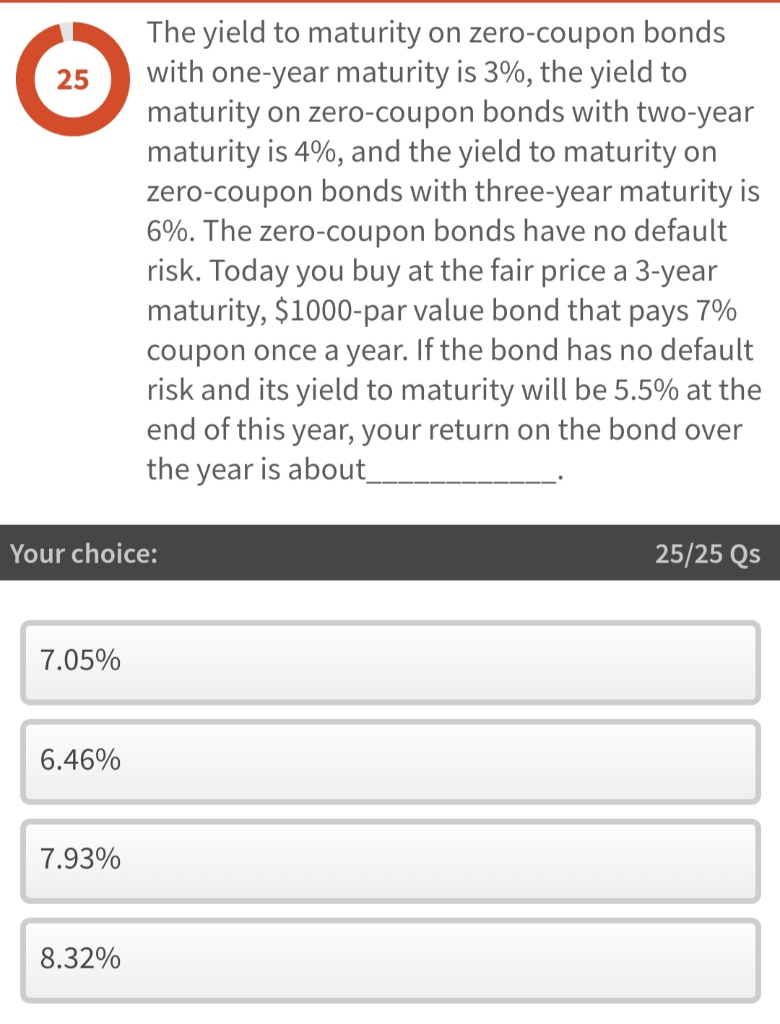

Yield to maturity for zero coupon bond. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Return of zero coupon bond. Yield to Maturity of zero coupon bond Learn how to calculate effective annual rate of zero coupon bond using formula approach. @RK varsity What Is a Zero-Coupon Bond? - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term. For the accrued interest - org.639deals.nl Let us imagine the yield on zero coupon bonds of comparable risk with maturity of 6 months, 1 years and 1.5 years is 4%, 4.1% and 4.5%. ... The bond's yield to maturity is the interest rate at which the present value of all future cash flows is equal to the bond's current price. These cash flows consist of all coupon payments and the. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Solved The yield to maturity of one-year zero coupon bond is | Chegg.com The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6%, specify the arbitrage trading strategy. Question: The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6% ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield To Maturity And Zero Coupon Bonds - nycviplimos.com Don't yield to maturity and zero coupon bonds miss this opportunity to save at store with this Honda Parts Unlimited coupon. I'd have never imagined the difference the dual blades could make. You'll find cheaper accommodations in San Antonio in September and October. A general manager at a HomeMade Pizza in Chicago said that he learned about ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · At issuance, a bond's yield will equal the coupon rate if the bond was issued at par value. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months...

The yield to maturity on 1-year zero-coupon bonds is | Chegg.com Expert Answer. Transcribed image text: The yield to maturity on 1-year zero-coupon bonds is currently 6%; the YTM on 2-year zeros is 7%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 8.5%. The face value of the bond is $100. a.

axrh.woogee.info Yield to maturity is used to determine the annual yield that a bond will pay the holder from the current date until the date of maturity . The yield will include both interest payments paid to the bond holder, as well as any capital gain that may occur. Use the yield to maturity calculator below to solve the problem.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1 Zero-Coupon Bond YTM Example Consider a $1,000...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

consider a coupon bond that has a 900 par value and a coupon rate of 6 the bond is currently selling

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 yield to maturity for zero coupon bond"