43 us treasury bonds coupon rate

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Treasury Inspector General for Tax Administration. If you want to confidentially report misconduct, waste, fraud, or abuse by an IRS employee, you can call 800-366-4484 (call 800-877-8339 if you are deaf, hard of hearing, or have a speech disability, and are using TTY/TDD equipment). You can remain anonymous. Photographs of missing children.

Us treasury bonds coupon rate

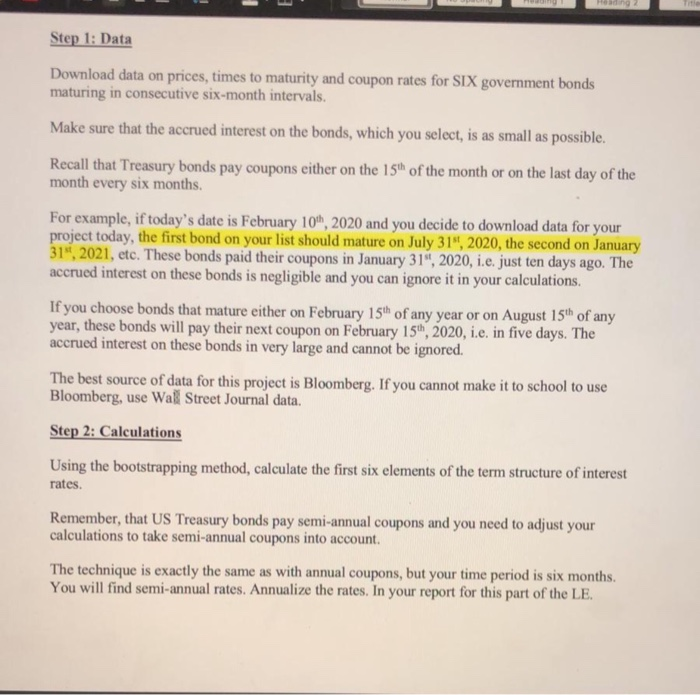

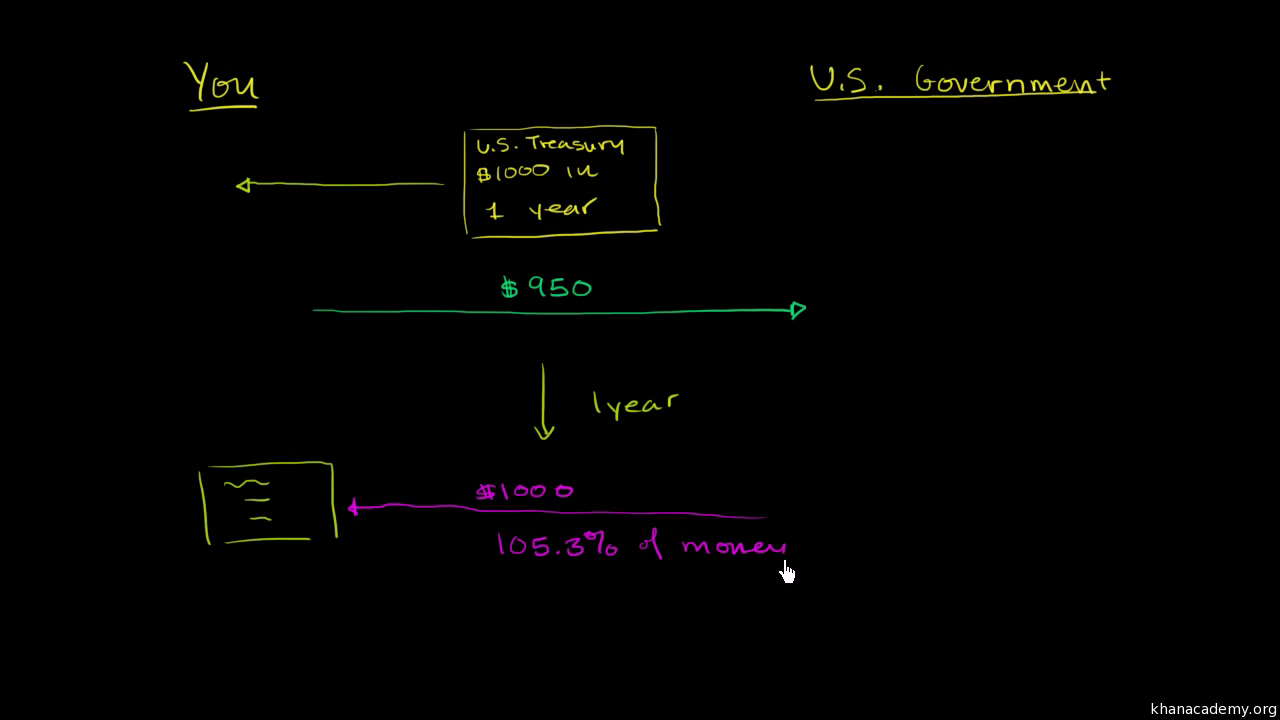

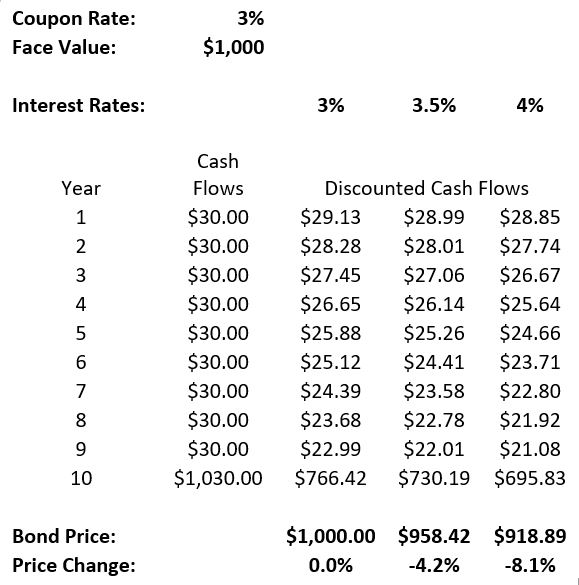

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · That said, zero coupon bonds carry various types of risk. Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Business News, Personal Finance and Money News - ABC News Nov 04, 2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

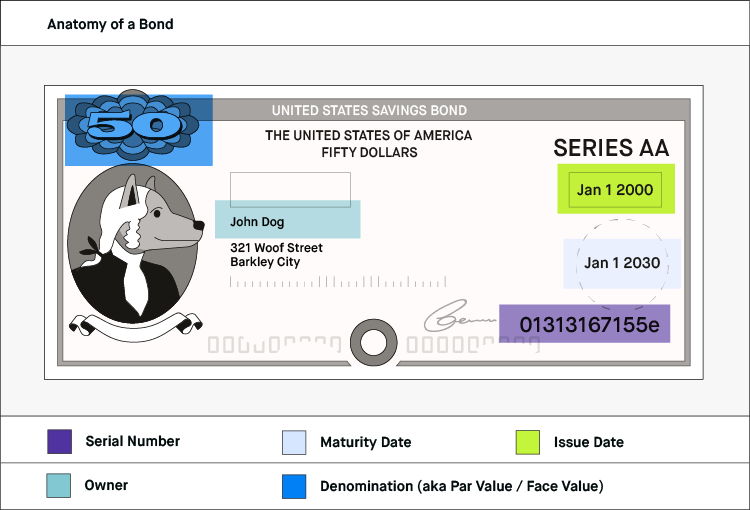

Us treasury bonds coupon rate. Russian Harmful Foreign Activities Sanctions | U.S. Department of … Apr 15, 2021 · Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... Savings Bonds - Treasury Securities. Bank Secrecy Act - Fincen 114 and more. ... General licenses allow all US persons to engage in the activity described in the general license without needing to apply for a specific license. Understanding Pricing and Interest Rates — TreasuryDirect The interest rate of an FRN changes, or “floats,” over the life of the FRN. The interest rate is the sum of two parts: an index rate and a spread. Index rate - The index rate of your FRN is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week bill every week, so the index rate of an FRN ... How to Buy US Treasury Bonds (Ameritrade, Fidelity, and more) Dec 22, 2021 · Unlike stocks, there isn’t a huge difference in price with bonds. Par is $100, the face value that US Treasury Bonds sell for. If the coupon rate is higher than the interest rate, they will add a premium. So, if a coupon price is paying 5.25% and the interest on the bond is only 1.4%, you’ll pay more per bond than $100. How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow May 06, 2021 · In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six months. Here is an example of a treasury bond with a par value of $100 and an interest rate of 5 percent.

Bonds & Rates - WSJ US Economic Calendar 11/05/22. ... Rocky Treasury-Market Trading Rattles Wall Street. ... Bonds: Bond quotes are updated in real-time. Sources: FactSet, Tullett Prebon. Foreign Account Tax Compliance Act | U.S. Department of the ... Nov 01, 2022 · FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with the FATCA Intergovernmental ... Stock Market Data – US Markets, World Markets, After Hours ... Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Business News, Personal Finance and Money News - ABC News Nov 04, 2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · That said, zero coupon bonds carry various types of risk. Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall.

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

Post a Comment for "43 us treasury bonds coupon rate"