45 treasury bonds coupon rate

Treasury Bonds — TreasuryDirect Treasury Bonds Treasury Bonds We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. You can hold a bond until it matures or sell it before it matures. Treasury Bonds are not the same as U.S. savings bonds EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. Treasury Bonds | CBK Most Treasury bonds in Kenya are fixed rate, meaning that the interest rate determined at auction is locked in for the entire life of the bond. This makes Treasury bonds a predictable, long-term source of income. ... Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer...

Treasury bonds coupon rate

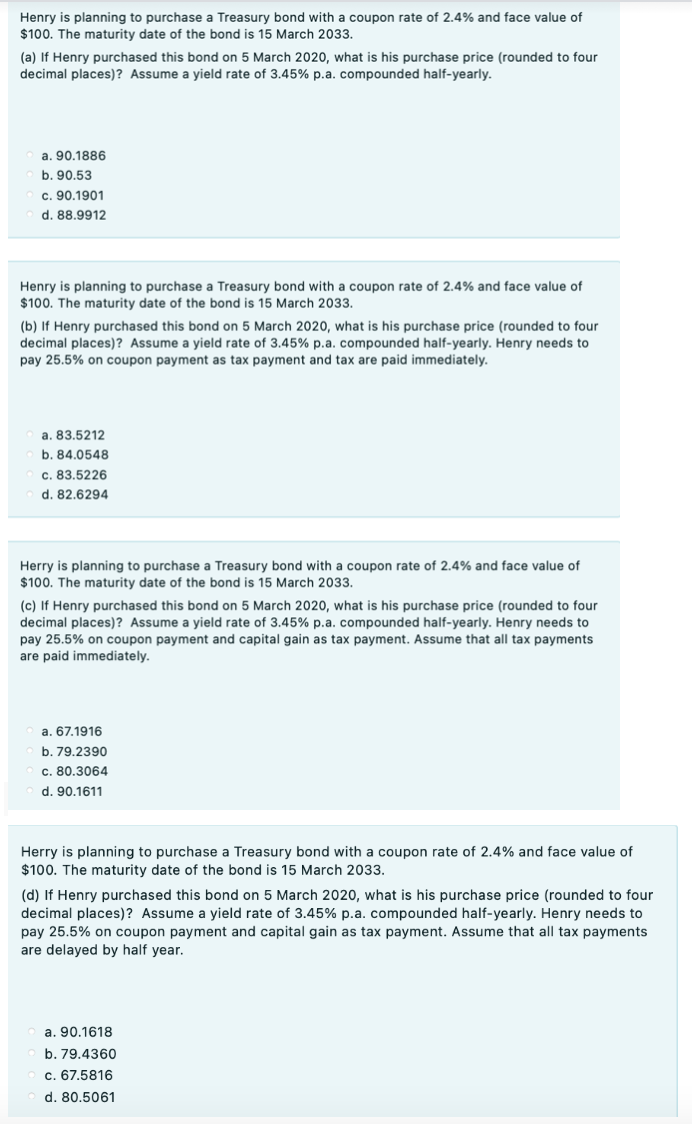

How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Bonds are sold in par value increments of $100. The "maturity date" of a treasury bond is always 30 years from the date the bonds are issued. In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ...

Treasury bonds coupon rate. Treasury Bonds | AOFM Treasury Bonds. Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bond lines. Coupon and Maturity (click for term sheet) What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... I Bond Rate: Yield Resets at 6.89% After Record $3 Billion Sold in One ... Series I savings bonds issued over the next six months will pay a yield of 6.89%, down from a record high as inflation shows some early signs of cooling. The new rate, announced Tuesday, will ... PDF As of September 30, 2022 In Million Pesos ISSUE/ ISIN RE-ISSUE ... Outstanding Treasury Bonds Issued by the Nat'l. Government As of September 30, 2022 In Million Pesos ISSUE/ RE-ISSUE * MATURITY COUPON FACE DATE DATE RATE AMOUNT ... RE-ISSUE * MATURITY COUPON FACE DATE DATE RATE AMOUNT ISIN 10 Years 1,373,118.46 PIBD1022L585 06-Dec-12 06-Dec-22 4.0000% 51,475.46

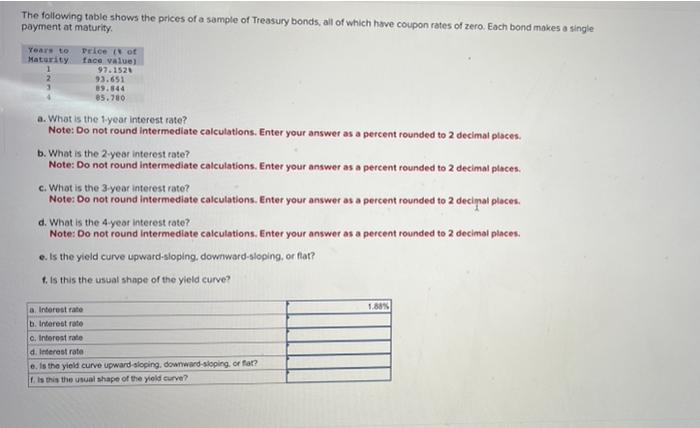

Sanctions Programs and Country Information | U.S. Department of … Nov 04, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ... The following table shows the prices of a sample of | Chegg.com Question: The following table shows the prices of a sample of Treasury bonds, all of which have coupon rates of zero. Each bond makes a single payment at maturity. o. What is the 1-year interestrate? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal ploces. b. What is the 2 -year interest rate? I bonds interest rates — TreasuryDirect Current Interest Rate Series I Savings Bonds 6.89% For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ...

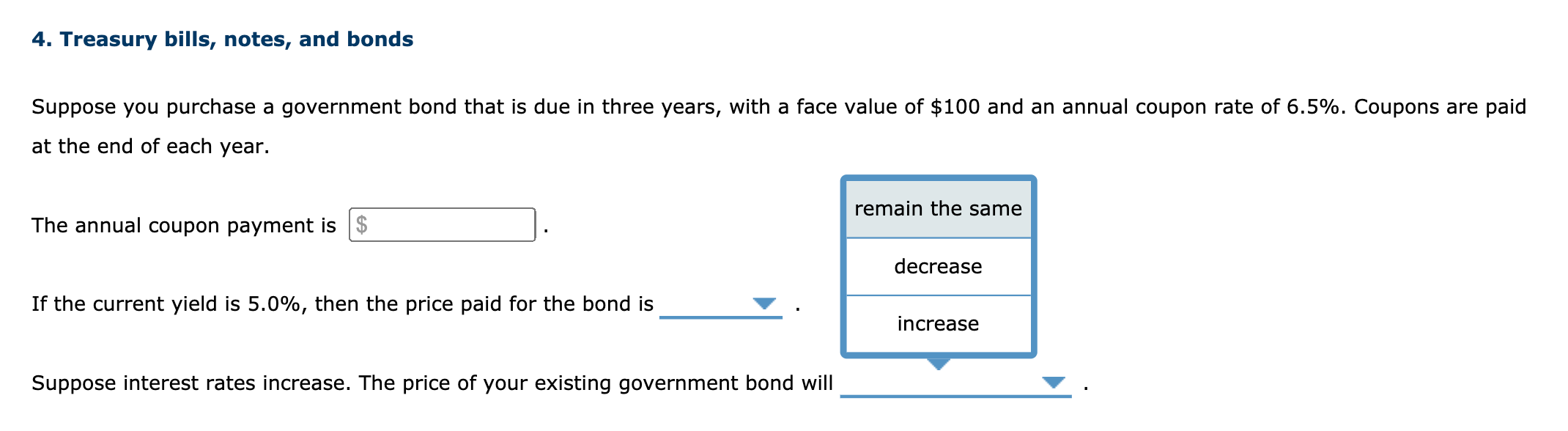

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value... Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). How the Treasury Market Predicts and Influence Interest Rates - The New ... The market for U.S. government bonds, called the Treasury market, offers predictions on the path for interest rates and the economy. Send any friend a story As a subscriber, you have 10 gift ...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

Treasury bills indexed to TONIA — METIKAM Treasury bills indexed to the TONIA rate (METIKAM) are long-term coupon securities issued by the Ministry of Finance of the Republic of Kazakhstan. The maturity of these securities is more than one year, the nominal value is 1000 tenge, the income is paid in the form of a coupon twice a year. Placement and redemption of securities takes place ...

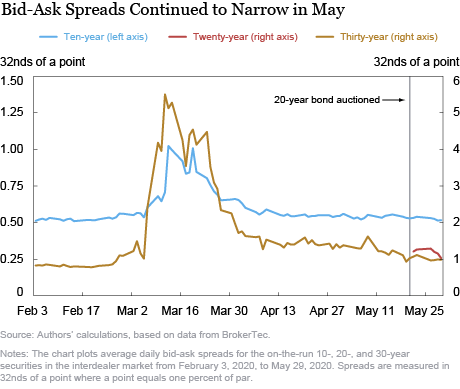

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... The Treasury yield is the interest rate that the U ...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ...

I bonds — TreasuryDirect Compare I savings bonds to TIPS (Treasury's marketable inflation-protected security) Current Interest Rate Series I Savings Bonds 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. Learn more I bonds at a Glance

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

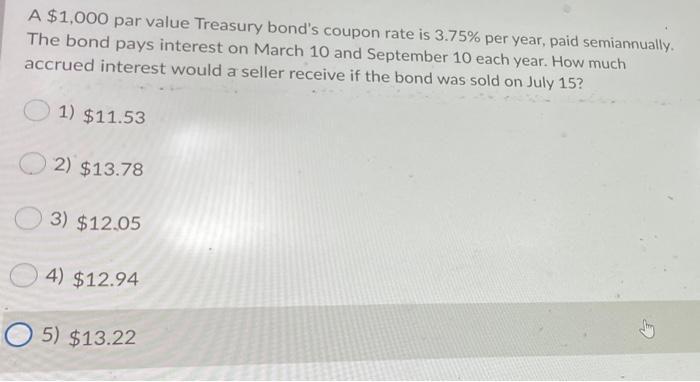

Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

Bonds & Rates - WSJ Bonds & Rates News. Fed’s Hard Line on Interest Rates Fuels Bond Rout. Rocky Treasury-Market Trading Rattles Wall Street. Investors Yanked Billions from Chinese Bonds as Yuan Slumped.

Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Bonds are sold in par value increments of $100. The "maturity date" of a treasury bond is always 30 years from the date the bonds are issued. In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

Post a Comment for "45 treasury bonds coupon rate"